So you’ve found the right supplier who has the product at the right place for you and you’re ready to click the “Pay Now” button.

![]()

But wait – you’re wondering should I use Paypal or Alibaba’s escrow service? What’s this I hear about T/Ts and L/Cs? What about Western Union? Here is an overview of the common payment methods for small business importers and my recommendations.

80/20 rule:

For small volume importers the most commonly used payment methods are:

- Paypal

- Escrow “Alibaba Secure Payment”

- Bank wire transfer or “T/T” – but be sure to negotiate the right payment terms

What NOT to use:

- Western Union – Carries a high risk of getting scammed because it offers little protection

- Letters of credit or “L/C’s – AVOID because they involve a lot of paperwork and bureaucracy which isn’t worth your time at this stage.

Paypal

Paypal is widely used around the world. It offers payment protection for buyers, is fast and easy to use. So why not use this to pay all your Chinese suppliers? First, Paypal is not widely accepted in China. Alipay is the standard in China. Second, though Paypal is free for buyers, sellers are charged fees for this and they will pass this on to you, the buyer. So that means an additional 4% to 5% added to your order total. Can you afford this?

Recommendation: Good for samples and small orders. Also it’s a great way to reduce risk when placing with initial orders with new suppliers who you are still evaluating. But as orders grow larger and trust builds consider moving to bank transfers to reduce costs.

Pros:

- Widely used around the world (though not popular in China)

- Payment protection

- Fast

- Free for buyers

- Flexible payment – Can pay using a credit card or by bank transfer

Cons:

- Not widely accepted by suppliers in China

- Added cost – Suppliers will typically add 4% to 5% to your total order value which you will typically pay for (whether you are aware of it or not)

Best practice: If you are considering Paypal, ask suppliers in the early negotiations stage (e.g. RFQ and follow up questions) whether they accept Paypal. You don’t want to spend all your time negotiating only to find out at the last minute they don’t accept Paypal.

Escrow service: Alibaba secure payment

Alibaba besides having their trading platform also offers an escrow service called Alibaba Secure Payment (formerly “Alibaba Escrow”). The main benefit to you the buyer is that they can hold the funds in escrow until you receive and approve the order. In case of any problems you can file a dispute and Alibaba will mediate to help you get a refund.

As to whether you can get a complete refund depends on the circumstances. In case of any quality disputes, Alibaba requires a 3rd party inspection which normally costs US$200-$300 to verify the problem.

Another downside is that it is limited to pre-approved suppliers on Alibaba only. If you found your suppliers on Global Sources or at a trade show for example, they will not qualify unless they are a pre-approved Alibaba supplier. In addition not all Alibaba suppliers are willing to accept this because Alibaba charges them a 5% fee for this service (which they will pass on to you) not to mention the additional work and risk for them.

Recommendation: Alipay secure payment is good for paying pre-approved Alibaba suppliers. Like Paypal, I suggest you use this when paying for samples and small orders. But do make a cost calculation to find out if it makes sense for you.

Pros

- Reduces your risk – Alibaba will hold the payment until you receive your order and are satisfied

- Easy to use if you’re sourcing using Alibaba – Integrates well with their system and no need to create a separate account with an escrow service elsewhere

- Free for buyers

- Flexible payment – Can pay using a credit card or by bank transfer

Cons:

- Limited application – Can only be used with pre-approved suppliers on Alibaba

- Not all suppliers qualify or will agree to this

- You must make a full payment which ties up your cash flow

- Added cost – While this is free for buyers, Alibaba charges suppliers 5% for this service and they will pass on the cost to you

Bank wire transfer or T/T

Many people are intimidated by bank transfers. In fact this is the most common way of paying suppliers in my experience. Wire transfers are widely used around the world. Banks normally charge a fixed bank transfer fee of $30 to $50 depending on your bank. Obviously this makes sense for larger orders.

Pros:

- Widely accepted around the world

- Fixed bank transfer fees which are good for larger orders

- Costs normally between USD $30 to $50 per transfer depending on your bank

- Can negotiate for payment terms for smaller deposit upfront and balance paid later – reduces risk and frees up cash flow

Cons

- Cannot (easily) get your money bank

- Must be careful with the fine print – any errors in the transfer details will cause tremendous delays

- Slow – can take up to 5-7 business days

Recommendation: Take advantage of the low fixed costs and use T/Ts for for larger orders with trusted suppliers.

Best Practice: To reduce risk when paying new suppliers, negotiate payment terms so that you pay a proportion of the money upfront as a deposit and the remaining balance upon inspection or delivery. This will incentivise the supplier to fix problems as they arise (Murphy’s Law). For example 30% advance payment and 70% balance paid upon inspection and approval.

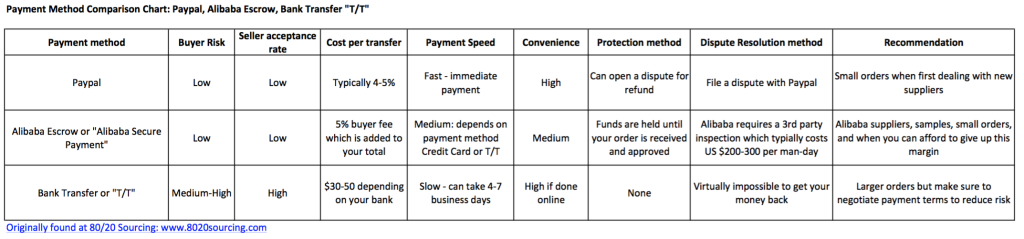

Here’s a quick comparison chart of Paypal, Alibaba Secure Payment, and Bank wire transfers (click to enlarge)

Remember Paypal for small orders, Alibaba Escrow for orders done on Alibaba so long you are OK with paying the 5%, and T/T when orders are ramping up but make sure to negotiate the right payment terms. I will show you how to do this in a future article. Please sign up to be invited to my free newsletter to get the article delivered to your inbox.

Case study:

Let’s say you have already placed a sample order and tested the product. You’re ready to place your next order with a value of about $10,000. If paying using Paypal it will incur about $400-500 worth of fees. On the other hand if you use T/T it will only cost you about $50 (depending on your bank) per transfer. If you arrange payment terms of 30% advance and 70% upon shipment, it will still only cost about $100. So it doesn’t take a genius which one makes more sense.

Which payment terms are you using and what problems are you facing? I look forward to your comments below.

Please signup for my newsletter for a “deeper dive” into these topics. Good luck!