Update Sept 17, 2018

Talks continue to heat up in the US-China “trade war” recently. So far two China tariff lists have already taken effect in July and August respectively and now there is a third one looming. And this one could be the one that affects your products.

To give you a background, here are the lists of items covered in the three China Tariffs lists so far.

China Tariffs List 1: $34 Billion – 25% increase in tariffs – Took effect on July 6, 2018

China Tariffs List 2: $16 Billion – 25% increase in tariffs – Took effect on Aug 23, 2018

“$200 Billion list” – 10% or 25% increase in tariffs proposed – uncertain when they will take effect

Lists 1 and 2 have already taken effect in July and August of 2018 and if your product is listed that means that there will be an additional 25% duty rate on top of your current duty rate for products imported into the US from China.

The third “$200 billion” list is proposed by Trump to face an additional 10% or 25% duty. Talks are still underway and it’s uncertain when and if they will take effect.

There has been a lot of misunderstanding as to exactly how much the tariff will amount to. To be clear this is an EXTRA 10% or 25% on top of the current duty that you’re paying.

For example, if your product’s HS code is mention on the above list(s) and you’re currently paying 5% duty prior to these new tariffs, and if the 25% passes now you will be paying 30% duties (5% + 25%)!

Not sure? Ask your Customs Brokerage or Freight forwarder to clarify if they will be covered.

To give you an idea of size of the impact of these tariffs… The three lists total about $250 billion in products. This is about half of all China imports in 2017 according to US Census data.

What can you do?

1) Check if your products are affected by checking the HS Code. As a best practice, you should check the accuracy of your tariff code with your customs broker.

2) If you are affected and if you are it looks like it will be an extra 25% duty on top of what you’re already paying, decide how/if you can absorb the cost.

Some vendors say that they will pass the costs onto the consumer. But there’s a big jump from a 10% increase versus a 25% increase. At 10% the cost, while painful, might be able to be absorbed by the customer, supplier, and retailer.

At 25%, customers may vanish… along with your profits.

3) The logical conclusion is to source outside of China but it’s easier said than done.

Though countries in SE Asia and South Asia may not be prone to tariffs, it is often harder to find quality suppliers. In many instances, labor costs may not be significantly cheaper than were once thought. In other instances, you may find that there is a lower productivity from suppliers outside of China.

Besides that, there may be longer lead times for shipping in these other countries as their supply chains are not as efficient as the ones in China. Furthermore, there may be additional hidden costs (graft, etc) in these other countries that will chip away at your dreams of finding a cheap supplier away from China.

Ultimately this leads us to…

4) Dealing with Uncertainty

This is the only certainty. That things with the trade tariffs and trade war will be UNCERTAIN. Businesses now are holding back on investments because they are not certain what will happen after the midterm elections in the US.

UPDATE June 18, 2018

On June 15, 2018, the US Trade Representative office released the list of items that will be hit with an additional 25% tariff or import duty.

This initiative was spearheaded by Donald Trump and Robert Lighthizer in an effort to protect against China’s alleged unfair trade practices.

Here is the list of items affected

As you can see most of the items listed are not consumer goods which you typically find on Amazon. Instead it covers mainly items related to heavy industries such as aircrafts, vehicles, manufacturing related tools and equipment, as well as electronic components.

According to the US Trade Representative Office – the idea is to counterbalance against the “Made in China 2025” initiatives and policies that China is using to push their homegrown technology and innovation.

In summary:

- The total value of this is $50 billion in 2018 trade figures

- The tariff rate will be an additional 25%

- “The list does not include goods commonly purchased by American consumers such as cellular telephones or televisions.”

Note that the items affected cover products imported from China only. Products manufactured in and imported from other countries such as India, Vietnam, and Mexico are not affected by these policies.

How will this affect online sellers?

I conducted a completely informal survey of Amazon sellers, and the products they are selling are not affected. But the key is in the details so check the list yourself.

Were your products affected by the new China tariff? If so, what will you do about it? Comment below and let me know.

—

In March of 2018, President Trump just signed a measure that the US will impose $50 billion in tariffs on Chinese imports. Sources say that import duties on Chinese products will rise to a flat rate of 25% if the details of the measure come to pass (more on that later)!

Why is Trump doing this?

The answer is business and politics in my view.

On one hand, Trump wants to reduce the US trade deficit with China. They want China to purchase more US products: from airplanes, to resources like natural gas, to raw materials, food and beverages, technology, and pharmaceutical products.

In addition, the US wants to nudge China to open up their market to US businesses. There have been accusations that China is not playing by the rules they agreed when they entered the World Trade Organization (WTO) over a decade ago. For example many feel that it is an unfair playing field for major US companies in China especially in the tech sector (Google, Facebook) and pharmaceuticals. There are also concerns of lack of Intellectual Property protection and “technology theft” in China.

In short, the US wants China to allow more open access and play by the WTO rules they agreed to when they joined.

So who will this affect?

Potentially any businesses that import products from China. This includes Amazon Sellers who source from China and ship those products to the US.

They may face HIGHER import duties. If you check with your customs broker you will find that most of your products have a duty rate in the single digits depending on your product. So if your products are affected by the new laws then the import tax you will pay will skyrocket to 25%!

China is not taking this sitting down. They are fighting back by imposing tariffs on US imports to China. US Pork, wine, steel pipes, and recycled aluminum will face higher import duties in China as a result.

What products will be affected by the tariff?

The answer is it depends.

Right now it’s in the hands of US Trade Representative Robert Lightizer. He has been appointed to review and submit a list of proposed products that will be affected by the tariffs by April 6, 2018.

Following that will be a 60 day period of review and comment period. “We’ll announce them before very long and then we’ll go through a 60-day period where we’ll give the public a chance to comment on the good and the bad things in there,” said Lighthizer.

This means the earliest the new tariffs will pass is June 2018.

While we don’t know the details of the products affected yet, Lightizer claims that the affected products are “largely high-technology things” picked by a computer algorithm.

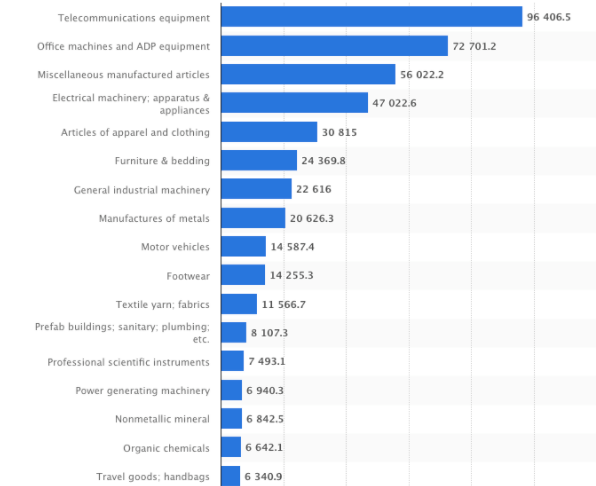

Again we don’t know the exact details until Lightizer’s review and report but broadly speaking these are the major categories of Chinese imports into the US. If I were to speculate then the categories near the top may fall within the “high technology things” he mentioned.

What can you do as an e-commerce business owner?

Smart sellers are already diversifying their sourcing away from China. They are sourcing products from Vietnam, India, and other countries.

However, before you say “Zai Jian (goodbye)” to China, remember sourcing and supply chain decisions aren’t solely made on price alone.

China’s manufacturing and export experience is quite mature now. Compared to that, many of China’s manufacturing competitors may not be able to compete in various ways. Beware that other countries may not be capable to manufacture the products that are made in China.

Also, their quality may be lower, their communications less efficient, and you may expect longer lead times as well.

But in all, “when the tide rises, all boats rise.” Depending on the final details of the tariffs and if your product categories are affected, you and all competitors will be paying the new higher prices to import your product. It’s going to be a level playing field for those importing from China. The US is just making China’s imports less competitive

Many sellers I’ve spoken to have decided that they will pass the costs onto their customers.

Recently I was contacted by Bloomberg and shared some of my thoughts from the Amazon sellers’ perspective: “On Amazon, more than half of product listings come from smaller businesses that source from China….and they would be hit hard.

“These guys are going to be left holding the new tariff bill and those prices will go straight up,” Huang said. “This year’s Christmas could be a lot more expensive.””

Tank you for this information. I am a new seller and this information is very disturbing. I hope that somewhere between now and June, this tariff thing is dissolved or a happy medium is reached.

Yes, I hope cooler heads will prevail but Trump just announced another $100 Billion dollars in proposed tariffs on China. We’ll see…

Hi, I am a new amazon seller. I live in Singapore, I am also a product designer with a Singapore based company. I wonder how to produce Singapore based private label product with the Chinese production aided.

Any Ideas?

Thanks.

Wang

Hey Gary – any update as we are nearing the end of June? Would love to see an updated article. Thanks for the great info.

If China becomes difficult for export to USA, then since Korea has been a strong manufacturer for decades, we can think about Korea as a sourcing country.

https://www.instagram.com/hakkentrade/

I do trade, dropship, agency for Korean products.

I’d happy to help you guys!

Thanks Jin Woo – I’m curious what manufacturing industries are best represented in Korea?